Zakat al-Fitr is a unique form of charity in Islam, prescribed for every Muslim who witnesses the month of Ramadan. It is obligatory, serves as a purification for the fasting person, and provides for the needy and poor so they can celebrate Eid. Distinct from Zakat al-Māl, Zakat al-Fitr has its own rules, purpose, and calculation method.

This guide will explain what Zakat al-Fitr is, its definition and ruling, the Prophetic hadiths related to it, how much it is in 2026, how to calculate it, who must pay it, and who receives it. It will also clarify the difference between Zakat al-Fitr and Zakat al-Māl, and the broader purpose behind this charitable act, combining spiritual purification with social support.

What Is Zakat al-Fitr?

Zakat al-Fitr is a mandatory form of charity prescribed for every living Muslim—male or female, young or old, free or enslaved—who witnesses the month of Ramadan, even if only a part of it before sunset on its final day. It is given by or at the end of Ramadan as an act of worship and social responsibility.

Read also:

How much is Zakat al-Fitr in 2026?

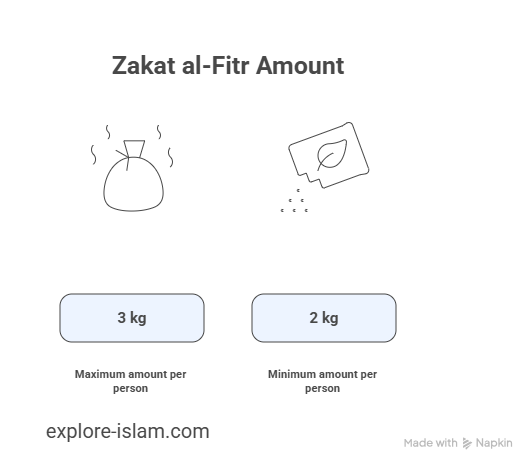

In modern measurements, Zakat al-Fitr in 2026 is equivalent to approximately 2 to 3 kilograms of rice or the staple food (ṭaʿām) commonly consumed in one’s country, per person.

Many contemporary scholars hold that Zakat al-Fitr may be given either as food or as its monetary equivalent, allowing the needy to purchase what best meets their essential needs.

Shaykh Ibn ʿUthaymīn (رحمه الله) estimated the amount of Zakat al-Fitr per person to be approximately 2,100 grams of staple food.

What is the purpose of Zakat al-Fitr?

There are numerous purposes for Zakat al-Fitr, here are the most important ones:

- Zakat is an Islamic obligation so it is an obedience to do in submission seeking the pleasure and rewards of Allah.

- It is an integral part of the perfect social welfare Islamic system. This Zakat is to help the poor and needy, and guarantees at least the bare-minimum for every Muslim in his community during Eid as a sort of collaboration between all Muslims in their communities.

- Zakat al-Fitr, as all types of worship acts in Islam precipitates Taqwah (Fear and Love of Allah) in the heart of a Muslim as a fruit of submission to Allah.

- It is done to show thankfulness to Allah for enabling the Muslim to observe Sawm.

- Another purpose is to purify a Muslim’s fast from any indecent acts or speech, imperfections and short comings. Ibn Abbas related: that Allah’s messenger prescribed the zakat relating to the breaking of the fast as a purification of the fasting from empty and obscene talk and as food for the poor. (Abu Dawud)

Read more: What is Ramadan

Is Zakat al-Fitr Obligatory? (Ruling on Zakat al-Fitr)

Yes, Zakat al-Fitr is obligatory upon every living Muslim—male or female, young or old, free or enslaved—who witnesses the month of Ramadan, even if only for a moment before sunset on its final day. It is due on behalf of oneself and those one is responsible for, including children and newborns.

Read more:

Zakat al-Fitr Hadiths

Among the hadiths discussing the obligation, amount, timing and purpose of zakat al-Fitr are the following two hadiths:

Hadith on Obligation and Amount of Zakat al-Fitr

The first hadith establishes that Zakat al-Fitr is obligatory upon every Muslim, regardless of gender or social status, and clarifies its standard measure using staple foods.

“The Messenger of Allah ﷺ prescribed Zakat al-Fitr at the end of Ramadan as one sāʿ of dates or one sāʿ of barley, to be paid by every Muslim—slave or free, male or female.”

— Sahih Sunan Abi Dawud

Hadith on Purpose and Timing of Zakat al-Fitr

The second hadith highlights the wisdom of Zakat al-Fitr. It also clearly defines the correct time of payment—before the Eid prayer—to fulfill its obligatory status.

“The Messenger of Allah ﷺ enjoined Zakat al-Fitr upon the fasting person as purification from idle talk and indecent speech, and as food for the needy. Whoever gives it before the Eid prayer, it is accepted as Zakah; and whoever gives it after the prayer, it is considered charity (ṣadaqah).”

Difference Between Zakat al-Māl and Zakat al-Fitr

Understanding the difference between Zakat al-Māl and Zakat al-Fitr helps clarify how charity functions within Islam’s moral and social system. While both are mandatory forms of giving, each serves a distinct purpose, follows different rules, and reflects Islam’s balance between spiritual purification and social responsibility.

| Aspect | Zakat al-Māl (زكاة المال) | Zakat al-Fitr (زكاة الفطر) |

| Islamic Ruling | One of the Five Pillars of Islam | Obligatory, but not a pillar |

| Who Must Pay | Muslims who own qualifying wealth | Every Muslim who can afford it |

| Type of Obligation | Due on specific types of wealth | Due on the person, not wealth |

| Wealth Included | Cash, trade goods, livestock, crops, etc. | Staple food (or its equivalent value) |

| Condition | Reaching the niṣāb and passage of one lunar year | No niṣāb or year required |

| Time of Payment | Any time after the year passes | Before Eid al-Fitr prayer |

| Purpose | Purifies wealth and supports society | Purifies the fast and feeds the poor |

| Religious Status of Denial | Denial equals disbelief; withholding is a major sin | Denial does not equal disbelief |

| Primary Beneficiaries | Eight categories mentioned in the Qur’an | Primarily the poor and needy |

| Main Objective | Financial justice and wealth purification | Allowing the poor to celebrate Eid |

When was Zakat al-Fitr ordained?

Zakat al-Fitr was ordained during the month of Sha’ban in the second year of Hijrah along with the Ramadan Sawm obligation.

Before that, Muslims were commanded to Fast Ashora’ day and pay Zakat al-Fitr after it.

Who receives Zakat al-Fitr?

Zakat al-Fitr is received by those who are poor and needy. During Eid, all should be guaranteed sufficient provisions for at least the day of Eid.

Ibn ‘Abbas RAA said: The Messenger of Allah PBUH enjoined Zakat al-Fitr as a purification for the fasting person from idle and obscene speech, and to feed the poor. Whoever gives it before the prayer, it is Zakat al-Fitr, and whoever gives it after the prayer, it is ordinary charity.

(Sahih Abi Dawud)

Who pays Zakat al-Fitr?

Zakat al-Fitr is due from every Muslim individual, provided they possess enough food or wealth beyond their basic needs on the night and day of Eid.

It is required from:

- Men and women

- Adults and children

- The elderly

- Newborns who are born before sunset on the last day of Ramadan

Those who cannot afford it are exempt.

The guardian or head of the household pays Zakat al-Fitr on behalf of those under their care, such as children and dependents.

Read:

How to Calculate Zakat al-Fitr

Zakat al-Fitr is one sāʿ of food per person, as taught by the Prophet ﷺ.

- Measure: One sāʿ equals four double handfuls, roughly 2–3 kg in modern weights.

- Type of Food: Can be dates, barley, or the staple food of your country.

This applies to every person under your care, including children and dependents.

Do you pay Zakat al-Fitr on behalf of a fetus?

Zakat al-Fitr is not obligatory to give it on behalf of a fetus according to scholarly consensus, but it is Mustahab (liked), because ‘Uthman RAA did that.

Do you pay Zakat al-Fitr on behalf of a dead person?

Ramadan starts from the Maghrib (sunset) of the night stating Ramadan till sunset on the night before Eid. If a Muslim dies after witnessing the sunset on the night before Eid (due time of Zakat al-Fitr), then Zakat al-Fitr should be paid on his/her behalf; otherwise, it is not due.

Read also: What after Ramadan

Conclusion

To conclude, every living Muslim (slave or free, male or female, young or old even a newborn) is obligated to pay Zakat al-Fitr at the conclusion of the month of Ramadan as a token of thankfulness and gratefulness to God for having enabled him to observe Sawm. Its purpose is to purify those who offered Sawm from any indecent act or speech and provide help to the poor and needy.

Key Takeaways:

- Obligatory Charity: Required for every Muslim who witnesses Ramadan.

- Amount: Approximately 2–3 kg of staple food per person or its monetary equivalent.

- Recipients: The poor and needy, ensuring they can celebrate Eid.

- Distinct from Zakat al-Māl: Zakat al-Fitr is not from the five pillars of Islam, and it has a specific purpose, timing and fixed amount, regardless of the amount of money the giver has.

Fulfilling Zakat al-Fitr not only purifies wealth and soul but also uplifts the community, reflecting the universal values of compassion and social justice. What do you think of the circulatory wealth philosophy in Islam? Start a conversation with our team right now for a deeper discussion!